CPA (Certified Public Accountant) Exam Tutoring

Table of Contents

Prep for Your Accounting Career

If you’re a recent accounting graduate, an aspiring public accountant, or another professional looking to advance your career within the accounting and finance industries, there’s a very good chance you’re thinking of taking the Certified Public Accountant (CPA) exam. While other roles in the finance industry don’t necessarily require a specific certification, the vast majority of accounting roles require CPA accreditation. MyGuru recognizes that the CPA is an essential step toward an accounting career, and we can help you complete your journey toward passing the exam.

The CPA exam is operated by the American Institute of Certified Public Accountants (AICPA) in conjunction with the National Association of State Boards of Accountancy (NASBA). These are the governing bodies responsible for determining whether an individual will receive official certification as a CPA, and thus gain the right to fulfill most of the functions an accountant performs as part of their daily work.

Most people who become Certified Public Accountants have a track record of performing well academically. If you’re considering the CPA exam, there’s a good chance you’ve taken standardized tests such as the SAT and ACT in the past. You may have even taken the GMAT. While these exams are in some ways good practice for the CPA exam, the CPA is a wholly different beast. Rather than merely testing your aptitudes and skills, the CPA also tests your knowledge of a broad range of subjects. In particular, the CPA assesses your knowledge of accounting principles and practices, auditing and attestation, business environments and concepts, and regulation. Additionally, it requires you to demonstrate analytical skills, problem-solving skills, communication skills, attention to detail, time management, technical proficiency with industry-standard software and tools, and ethical judgment.

The good news is, MyGuru’s expert CPA tutors know just how to empower you to succeed on the exam by enhancing your skills, building your knowledge, and learning to apply those to the specific structure of this specific test. Our instructors have well-established track records of successfully guiding CPA candidates through their entire CPA exam journeys. They’ll collaborate with you every step of the way to design a completely customized CPA exam prep plan that will equip you with everything you need to earn your designation as a Certified Public Accountant.

The MyGuru Edge for CPA Prep

MyGuru was founded on a conviction that there is no such thing as a standardized student, even for standardized tests. Our CPA instructors are trained to recognize that each and every student arrives with a unique array of skills, vulnerabilities, objectives, and learning styles. MyGuru tutors are highly skilled at designing 100% tailored test prep regimens that help each student maximize their scoring potential. They offer a comprehensive understanding of the content on the CPA exam, as well as powerful insights into the test prep process, the structure of the CPA exam, and everything it takes to succeed.

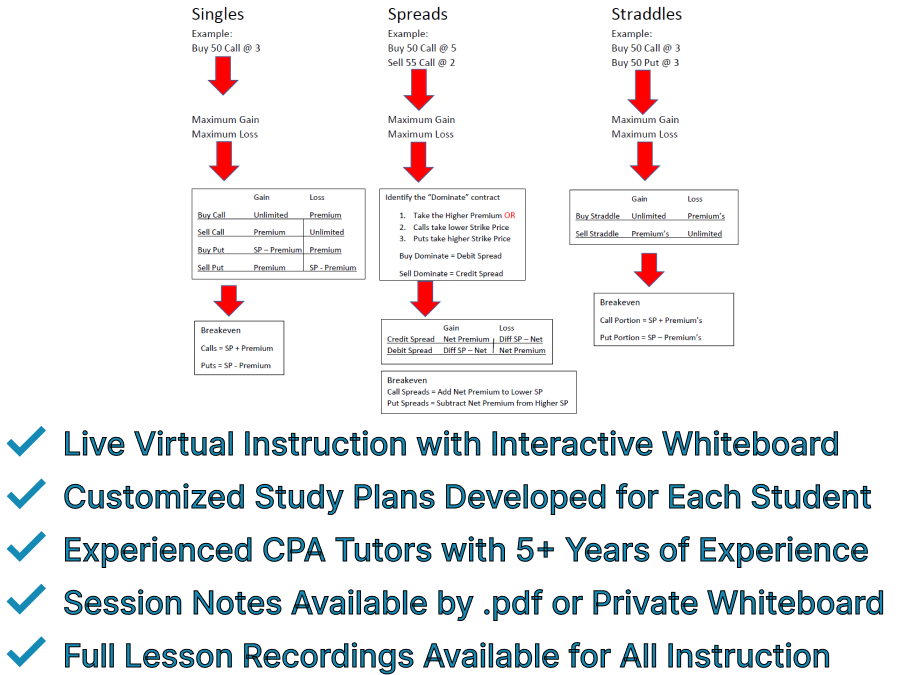

MyGuru tutors conduct CPA tutoring with the aid of highly interactive online whiteboarding tools, which require nothing more than an internet-connected computer, a microphone, and a camera. Our tutoring sessions are designed to include both live practice problems and comprehensive review of the test’s subject matter. This dual method allows our tutors to illustrate how CPA strategies can be used for future problems, helping you prepare effectively for your exam day.

The notes generated on the whiteboard during the live session are provided as static PDFs following the completion of each lesson or saved on a private-access whiteboard for future reference while allowing interaction between live sessions. These notes will evolve into a unique supplementary “textbook” containing focused review material, customized to the student's specific lesson plan and learning preferences, enhancing each student's learning experience in a way our competitors can’t match.

Request a CPA Tutor

Customized CPA Study

Selecting the right CPA tutor is a crucial decision and represents a major investment in your future. To aid in your decision-making process, we offer a complimentary 15-minute introductory videoconference with any of our CPA instructors. This session allows students to assess the most suitable approach for their personal CPA prep and accounting career goals. While we can also schedule a phone call, a videoconference is typically preferred as it offers a superior platform to showcase what distinguishes MyGuru from other CPA prep companies. During this videoconference, prospective students can:

- Test our live screen-sharing with an experienced MyGuru CPA instructor in order to assess the functionality of our dynamic whiteboarding tool and the distinctions between our standard and premium tutoring services

- Outline a customized CPA study schedule and possible supplementary prep materials that will facilitate the student’s ongoing learning with carefully chosen homework assignments and study plans between sessions

- Discuss their background with the CPA or other standardized tests they’ve taken or intend to take in the future, which will help the tutor gain a clearer understanding of their tutoring requirements

- Engage in a casual introductory conversation with the potential CPA tutor to ensure a good personality match and to assess if the tutor is well-positioned to lead the student’s CPA preparation journey

CPA Tutoring Pricing & Package Options

MyGuru is dedicated to providing the best possible return on investment, allowing you to begin your tutoring experience with just one hour of instruction and no long-term commitment. We also offer a range of instruction levels and hour packages to ensure maximum value for our clients. Our students consistently achieve passing scores on the CPA exam, which is necessary for obtaining the CPA certification and securing desirable positions with leading accounting firms. Additionally, many of our students go on to pass other finance-related exams such as the CFA, FRM, CAIA, CFP, and more, further empowering their professional success.

- Standard Online | $130 per hour | $600 for 5 hours | $1,400 for 12 hours | $2,700 for 24 hours

Our MyGuru Standard Online CPA tutoring option is our most economical choice, and is significantly more affordable than comparable services offered by our competitors. This service is customized to address each student's individual needs by matching them with an instructor who possesses extensive CPA tutoring experience. Furthermore, all Standard Online students receive a PDF of the whiteboard notes from each individual session via email within 24 hours of the lesson’s completion, providing the students with support as they continue their learning between sessions. - Premium Online | $200 per hour | $900 for 5 hours | $2,100 for 12 hours | $4,000 for 24 hours

Our MyGuru Premium Online CPA tutoring option offers the highest value, providing complete audio, video, and whiteboard recordings of every session that can be reviewed for up to three months after the final lesson has transpired. This option also includes access to a private interactive whiteboard, allowing students to implement strategies live during lessons and post questions or comments between sessions as they maintain communication with their instructor. MyGuru tutors monitor the board daily and respond according to the students’ needs, ensuring a comprehensive and interactive learning experience. - Expert Edge Online | $250 per hour | $1,125 for 5 hours | $2,600 for 12 hours | $5,000 for 24 hours

Have you failed the CPA exam in the past, or a practice CPA exam? Are you seeking the maximum possible boost in improving your score? If so, the best option for you is our Expert Edge Online CPA tutoring package with Suma Rajesh. Suma has accumulated over 1,500 hours of experience coaching aspiring accounting and financial professionals as they’ve prepped for the CPA and other exams. She’s also worked with students throughout the world, which has helped her develop a special fluidity in translating challenging subject matter.

Our tutoring packages are designed to be flexible and customizable, offering regular lessons of 60, 90 (the most common), or 120 minutes, based on the student’s needs and availability. Any additional time beyond the purchased package is billed at the prorated hourly rate of that package. We do provide refunds if you have unused hours at the end of your CPA prep, with a 5% processing fee deducted, as long as a minimum of 24-hours notice is provided for any cancelled or rescheduled session.

While not recommended for the computer-based CPA exam and lacking the dynamic features of our online tutoring options, we do offer in-person instruction in many major US cities upon request. In-person tutoring is offered at the same rate as our Premium Online instruction, subject to the instructor’s availability.

Your CPA Tutoring Guru

Our CPA tutoring team is led by Suma Rajesh. Suma began her career in the industry as a corporate credit analyst, working for banks operating throughout India and the Middle East. After several years, however, Suma began to realize that her true passion and calling lay in the realm of teaching. Suma began teaching finance and accounting at the Apex Professional Training Institute before moving on to serve as Director of the CMA program at Bradford Learning Global.

After many years of teaching with larger organizations, Suma moved to one-on-one tutoring, which has been the most meaningful work she’s done. In addition to the CPA exam, Suma teaches students studying for the CA, CIA, and CMA exams.

One of Suma’s strengths and proudest qualities as a tutor is her ability to translate challenging topics to meet any student’s background, communication style, and learning style. This derives from Suma’s extensive international experience. In addition to the countless students from the US she’s helped pass the CPA and other exams, she’s also tutored students from the UAE, Saudi Arabia, India, Pakistan, Indonesia, and many more. She has a personal goal of working with a student from every country on Earth, and she’s well on her way.

Nothing motivates Suma more than making a positive impact by helping students of all kinds navigate the hurdles necessary to climb the corporate ladder. And while she’s always working to become a better educator, her students praise not only her teaching abilities, but also her professionalism, her enthusiasm, and her motivational skills.

CPA Exam Overview

Business Environment & Concepts

The Business Environment and Concepts (BEC) portion of the CPA exam tests candidates’ understanding of the broader world of contemporary business, as well as the specific concepts and strategies that enable effective operations and decision-making. The BEC covers a wide range of subject matter, including:

- Corporate Governance

- Economic Concepts and Analysis

- Financial Management

- Information Technology

- Operations Management

- Strategic Planning

- Risk Management

- Information Systems

The BEC section’s formatting includes 62 multiple-choice questions, four task-based simulations, and three written communication tasks.

Financial Accounting & Reporting

The Financial Accounting and Reporting (FAR) section of the CPA is generally regarded as the most challenging and wide-ranging part of the test. On the whole, the FAR section tests candidates’ ability to apply accounting standards and principles to a different kinds of financial statements and transactions. Candidates must be able to apply generally accepted accounting principles (GAAP) to for-profit business enterprises, not-for-profit organizations, and government entities. During this portion of the exam, CPA candidates will need to demonstrate their ability to prepare and analyze financial statements, apply accounting standards updates, and manage challenging cases including consolidations, derivatives, and income taxes.

The formatting of the FAR section includes 66 multiple-choice questions and eight task-based simulations.

Regulation

More than any other section of the CPA exam, the Regulation (REG) section focuses on ethics, professional responsibilities, and the legal implications of accounting and business decisions. CPA candidates are tested on their understanding of business law and the tax procedures of the Internal Revenue Code, and candidates must apply their knowledge to a variety of scenarios involving individuals, partnerships, corporations, and other organizations. Other topics covered by the REG section’s content include:

- Contracts

- Sales

- Commercial Paper

- Agency Law

The questions on this section present candidates with complex scenarios involving issues of legal compliance and ethical dilemmas. The formatting includes 76 multiple-choice questions and eight task-based simulations.

Auditing & Attestation

The Auditing and Attestation (AUD) section of the exam evaluates candidates’ knowledge and skills in the areas of auditing processes, standards, and practices. The content on this portion of the exam covers every major facet of the auditing process, from planning to internal controls to evidence gathering to reporting. In addition to the ethical and legal responsibilities auditors hold, CPA candidates must have a working familiarity with the AICPA auditing standards and must demonstrate their ability to apply them in various scenarios. Other topics covered in the AUD section include:

- Professional Conduct

- Risk Assessment

- Fraud Detection

- Reviews

- Compilations

The formatting of the AUD section includes 72 multiple-choice question and eight task-based simulations, as well as occasional written communication tasks.

Why Take the SIE Exam?

The first and most obvious answer is that taking and passing the CPA advances your career. Many accounting and finance positions require a CPA. Additionally, you need a CPA to run an independent business as a public accountant. The CPA licensure is required in order to fulfill the duties of a public accountant, including signing audit reports, representing clients in front of the IRS, and holding certain senior-level accounting positions. Some of the positions that a CPA is helpful or necessary in order to fill include: public accountant, corporate accountant, tax consultant, financial analyst, forensic accountant, internal auditor, government accountant, nonprofit accountant, and small business owner.

As many of those roles demonstrate, taking and passing the CPA exam isn’t only beneficial if you want the word accountant in your title. Passing the CPA exam requires a rather comprehensive knowledge of the tax procedures in the United States, which is necessary for all businesses and individuals. Prepping for the CPA, therefore, will help you attain the knowledge and skills to drive your career in a number of directions.

Passing the CPA also demonstrates the attainment of that knowledge and skills, and of the characteristics necessary to acquire them and to apply them to the exam itself. Passing this extremely rigorous exam illustrates that you have the dedication, intelligence, motivation, and poise necessary to achieve such a difficult goal and to perform under pressure.

Proven CPA Study Strategies

If prepping for some financial exams is like training for a marathon, preparing for the CPA is like training for a super-marathon. It compels profound commitment and effort in order to succeed. To start, it’s recommended that all students—even those with an Accounting degree—commit to 1-2 hours of practice every day for at least six weeks. The AICPA & CIMA, which together design and facilitate the exam, offer valuable starting resources. You should first take a free sample test with officially endorsed CPA exam material, which will allow you to experience what it’s like to take the exam, to gauge your baseline score, to assess your current level or preparedness, and to identify your most important study topics.

Effective preparation also involves investing in additional online practice problems for regular ongoing education and practice. You should thoroughly review each set on your own—in conjunction with tutoring and other test prep practices—to maximize your learning. Taking breaks between practice sessions and reviewing answers is also crucial. This prevents simply accepting explanations at face value without building a thorough understanding of the concepts and strategies involved.

Accounting Career News & CPA Exam Tips

Finance & Accounting Exam News & Strategy

Phone

Chicago: 312-278-0321

info@myguruedge.com