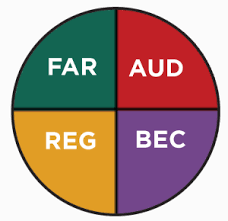

In what order should I take the Certified Public Accountant (CPA) Exam? It is a question that many new candidates ask themselves, and others, when starting off on their four-part CPA journey. While people will suggest many different approaches, those who have taken the exams in the past will mostly agree that you should not leave Regulation (REG) or Financial Accounting & Reporting (FAR) for last. There are several reasons for this. Among them, the pass rates for FAR (47.5%) and REG (49.3%) are considerably lower than the pass rates for Audit (AUD), at 52.1%, and Business Environment & Concepts (BEC), at 55.35% (all percentages as of the most recent quarter, shown here on the American Institute of Certified Public Accountants (AICPA) website).

In what order should I take the Certified Public Accountant (CPA) Exam? It is a question that many new candidates ask themselves, and others, when starting off on their four-part CPA journey. While people will suggest many different approaches, those who have taken the exams in the past will mostly agree that you should not leave Regulation (REG) or Financial Accounting & Reporting (FAR) for last. There are several reasons for this. Among them, the pass rates for FAR (47.5%) and REG (49.3%) are considerably lower than the pass rates for Audit (AUD), at 52.1%, and Business Environment & Concepts (BEC), at 55.35% (all percentages as of the most recent quarter, shown here on the American Institute of Certified Public Accountants (AICPA) website).

Just starting out on your path to becoming a Certified Public Accountant (CPA)? Unsure where to begin? One of the biggest decisions to make is the selection of a review course. Many people are familiar with Becker, Roger, Wiley CPAexcel, and Yaeger. There is also Surgent, Gleim, Kaplan, Ninja, Lambers, ExamMatrix, and more. With so many options available to a candidate, it may be difficult to determine what will work best. While some programs will boast about a high pass rate for its users, at the end of the day, the content provided is very similar --- is it simply delivered in varying formats.

Just starting out on your path to becoming a Certified Public Accountant (CPA)? Unsure where to begin? One of the biggest decisions to make is the selection of a review course. Many people are familiar with Becker, Roger, Wiley CPAexcel, and Yaeger. There is also Surgent, Gleim, Kaplan, Ninja, Lambers, ExamMatrix, and more. With so many options available to a candidate, it may be difficult to determine what will work best. While some programs will boast about a high pass rate for its users, at the end of the day, the content provided is very similar --- is it simply delivered in varying formats.  Just starting out on your path to becoming a Certified Public Accountant (CPA)? Unsure where to begin? One of the biggest decisions to make is the selection of a review course. Many people are familiar with Becker, Roger, Wiley CPAexcel, and Yaeger. There is also Surgent, Gleim, Kaplan, Ninja, Lambers, ExamMatrix, and more. With so many options available to a candidate, it may be difficult to determine what will work best. While some programs will boast about a high pass rate for its users, at the end of the day, the content provided is very similar --- is it simply delivered in varying formats.

Just starting out on your path to becoming a Certified Public Accountant (CPA)? Unsure where to begin? One of the biggest decisions to make is the selection of a review course. Many people are familiar with Becker, Roger, Wiley CPAexcel, and Yaeger. There is also Surgent, Gleim, Kaplan, Ninja, Lambers, ExamMatrix, and more. With so many options available to a candidate, it may be difficult to determine what will work best. While some programs will boast about a high pass rate for its users, at the end of the day, the content provided is very similar --- is it simply delivered in varying formats.

In what order should I take the Certified Public Accountant (CPA) Exam?

In what order should I take the Certified Public Accountant (CPA) Exam?  The CPA Exam is without question one of the most difficult exams on the planet. It takes proper planning and preparation to get through this daunting exam. The purpose of this article is to provide you with some tips and tricks on which section you should take first.

The CPA Exam is without question one of the most difficult exams on the planet. It takes proper planning and preparation to get through this daunting exam. The purpose of this article is to provide you with some tips and tricks on which section you should take first.